The Startling Rise of Multimillion-Dollar Verdicts

In recent years, the insurance industry has been increasingly confronted with a formidable challenge: nuclear verdicts. These are jury awards that soar beyond $10 million, and they are becoming more prevalent, especially in cases linked to product liability, auto accidents, and medical malpractice. The rise of these Nuclear Verdict Challenges is a critical trend to monitor.

Why Are Nuclear Verdicts on the Rise?

Escalating Cost of Living: This economic factor has a direct influence on jury decisions, often leading jurors to believe that higher compensation amounts are necessary. The awareness of Nuclear Verdict Challenges plays into this dynamic.

Public Sentiment Against Corporations: A growing disenchantment with corporate entities often manifests in jury decisions, with verdicts serving as a form of retribution.

The Profound Impact on Insurance Companies

The repercussions of Nuclear Verdict Challenges for insurance companies can be catastrophic. Beyond eroding profits and depleting reserves, they may increase reinsurance costs, drive restricted policy terms, and restrict coverage availability. They represent not just a financial burden but also a strategic challenge demanding immediate attention.

Strategies for Mitigating Risks

- Selective Case Management: It’s crucial to judiciously choose which cases go to trial.

- Embracing Alternative Dispute Resolutions: Methods like mediation and arbitration are increasingly favored to avoid the unpredictability of jury trials and the risks of Nuclear Verdict Challenges.

- Juror Education Initiatives: Informing jurors about the broader implications of nuclear verdicts is becoming a focus.

- Advocacy for Legal Reforms: Lobbying for changes, such as caps on damages awards, aims to create a more balanced civil justice environment.

Balancing Perspectives

While Nuclear Verdict Challenges pose a significant threat to insurers, they also underscore the importance of fair compensation for victims of negligence. This balance is crucial in discussions about reform and risk management.

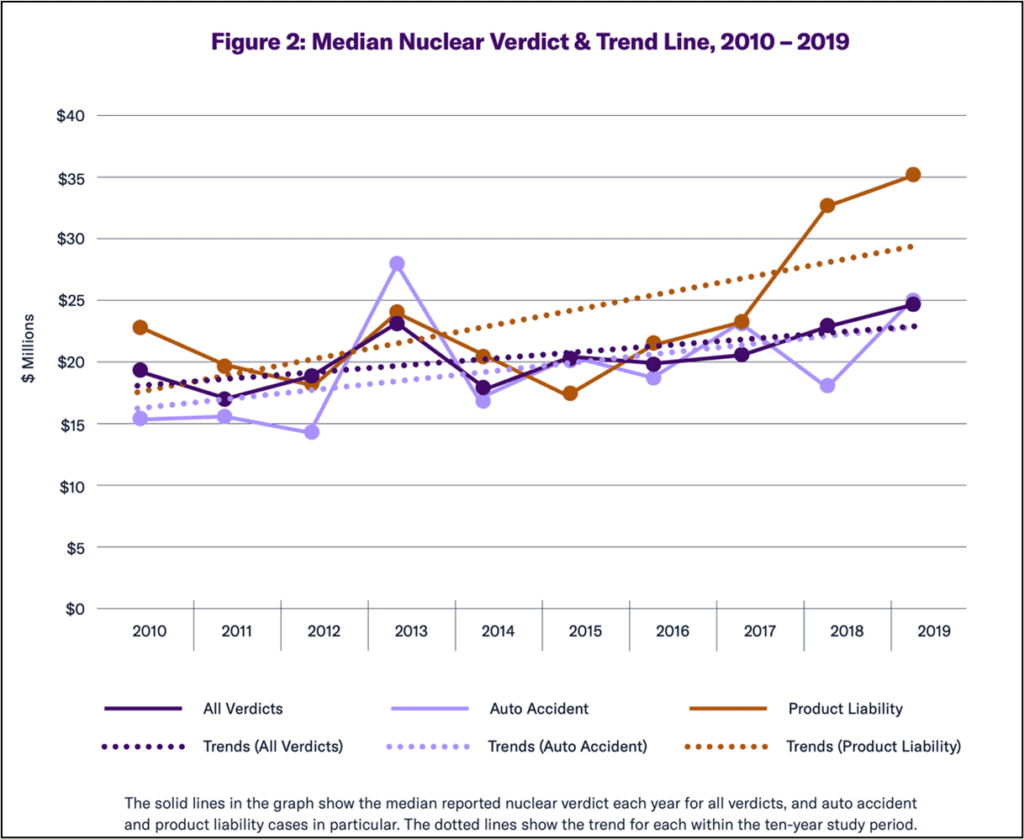

Visualizing the Trend

In conclusion, while Nuclear Verdict Challenges represent a serious threat to the financial stability of insurance companies, strategic case selection, alternative dispute resolution, juror education, and legal advocacy are key to managing this risk. Regular updates on this topic will be provided to reflect new developments.

Engage with Us

The impact of these claims affects all buyers of insurance and particularly insureds with higher product and auto liability exposure. We work proactively with our customers to advise on up front risk mitigation to help minimize the impact that these Nuclear Verdict Challenges may have on insurance costs.